Market-led proposals (MLPs) offer a pathway for private companies to pitch infrastructure and service projects directly to the government outside traditional procurement cycles. From highways and rail lines to digital platforms and renewable energy, MLPs can accelerate delivery, unlock innovation, and tap private capital. This guide explains how MLPs work in the United States and compares frameworks in the UK, Australia, Canada, and Germany, with practical steps for preparing and submitting a proposal.

PEOPLE ALSO READ : Crossroads Financial Technologies: A Simple Buyer’s Guide

What Is a Market-Led Proposal?

Short Definition

A market-led proposal is a private proponent’s idea for a public project submitted outside the normal tender process. The government screens it for public value, uniqueness, risk, and affordability. If it meets these tests, it can proceed to detailed assessment or move to open competition.

MLP vs Unsolicited Proposals vs Traditional Procurement

| Feature | Market-Led Proposal (MLP) | Unsolicited Proposal | Traditional Procurement |

| When used | Proponent brings novel idea; not in agency pipeline | Similar to MLP; varies by jurisdiction | Government identifies need first |

| Competition | May proceed direct or trigger tender | Often direct negotiation if unique | Always competitive tender |

| Typical outcome | Exclusive deal or open RFP | Exclusive contract or benchmark | Winning bid from tender |

| Risk allocation | Tailored during negotiation | Tailored during negotiation | Pre-defined in RFP |

| Innovation driver | High proponent-led concept | High proponent-led concept | Moderate government specs |

Note: In the US, “unsolicited proposal” is the common term; many states use it interchangeably with MLP. The key distinction is that MLPs typically involve stricter value-for-money and public interest tests before proceeding.

Who Uses MLPs and Why It Matters

Public Agencies (Benefits/Risks)

Benefits: Agencies gain access to private-sector innovation and financing without upfront capital costs. MLPs can fill gaps in the project pipeline, accelerate critical infrastructure, and transfer design, construction, and operational risk to experienced private partners.

Risks: Without robust probity controls, agencies face perceptions of favoritism or lack of transparency. Assessing complex proposals demands specialist resources, and poorly structured deals can lock in high costs or underperform on service quality.

Private Proponents (Benefits/Risks)

Benefits: Proponents can shape projects to their strengths, secure first-mover advantage, and negotiate risk allocation that reflects their capabilities. Successful MLPs can lead to long-term revenue streams and portfolio growth.

Risks: Bid costs are high and proposals require detailed technical, financial, and legal work with no guarantee of success. Governments may use the MLP as a benchmark and open the project to competitive tender, eroding the proponent’s advantage.

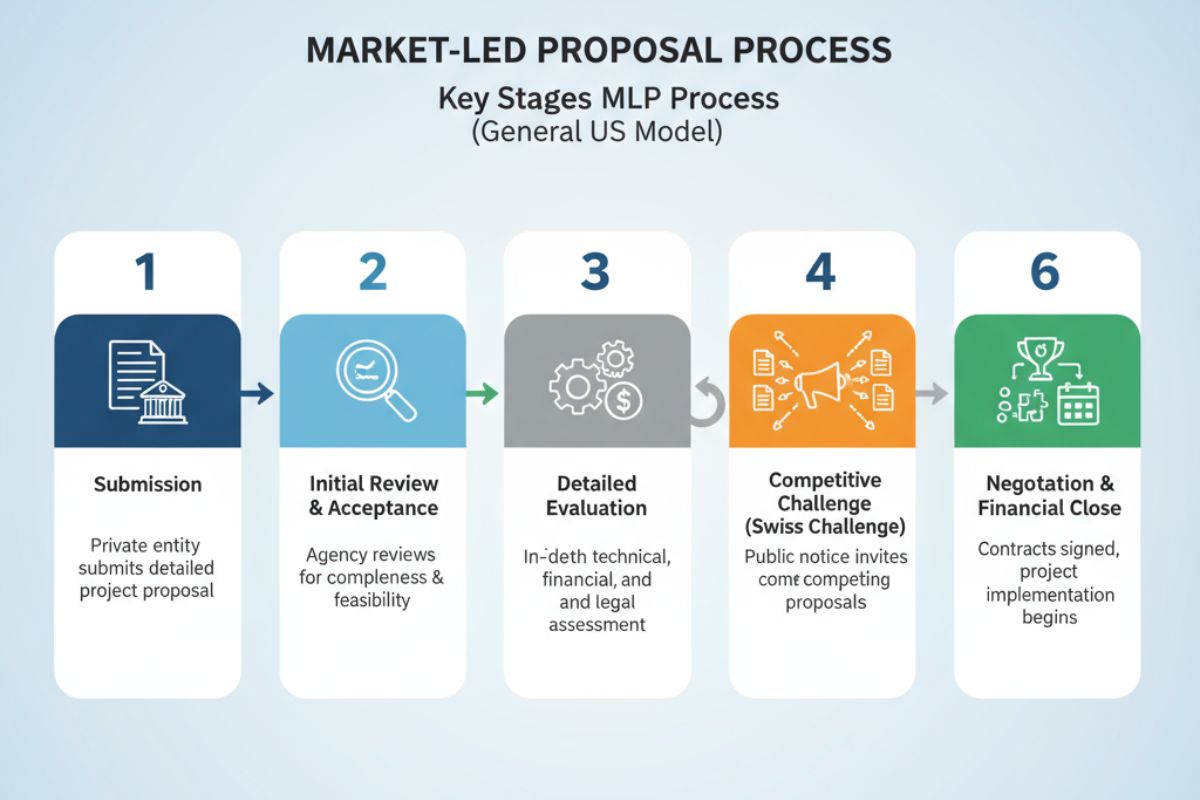

The MLP Process Step-by-Step

Market-led proposals typically follow a multi-stage gate process. Governments want to screen ideas quickly, assess feasibility thoroughly, and preserve competition where possible. Here’s how it works:

Stage 1: Idea and Screening

The proponent submits a brief concept paper (10–20 pages) outlining the project, its public benefit, and why it’s unique. The agency conducts a rapid screening usually within 30–60 days to determine if the idea aligns with policy priorities, offers genuine novelty, and warrants further assessment. Projects that duplicate existing pipelines or lack clear public value are rejected at this stage.

Stage 2: Initial Proposal and Assessment

If the concept passes screening, the proponent prepares a detailed initial proposal covering technical design, demand forecasts, cost estimates, funding model, risk allocation, and stakeholder impacts. The agency assembles a cross-functional team often including finance, legal, technical, and policy advisors to assess value for money, deliverability, and public interest. This stage can take 3–6 months and may involve proponent presentations and clarifications.

Stage 3: Detailed Proposal, Due Diligence

For proposals that meet assessment criteria, the agency invites a comprehensive detailed proposal. This includes a full business case, financial model, draft contracts, environmental and planning approvals, and third-party reports (e.g., traffic studies, engineering reviews). The agency conducts due diligence verifying assumptions, testing sensitivities, and engaging independent advisors. This phase typically runs 6–12 months and determines whether the project can proceed to negotiation or should move to competitive tender.

Stage 4: Negotiation and Decision

If the proposal offers unique value that cannot be replicated through competition, the agency may enter exclusive negotiations. Alternatively, the agency may use theMarket-led proposals (MLPs) as a reference design and issue a public tender, allowing other bidders to compete. Final contract award follows standard government approval processes, including Cabinet or Board sign-off and legislative oversight where required.

Evaluation Criteria: Value for Money, Public Interest, Uniqueness, Deliverability

Governments assess Market-led proposals (MLPs) against four core criteria:

- Value for money: Does the project deliver outcomes more cost-effectively than public delivery or alternative procurement routes? Agencies compare whole-of-life costs, service quality, and risk-adjusted returns.

- Public interest: Does it meet genuine public need, align with strategic plans, and deliver measurable community benefits? Social, environmental, and economic impacts are weighed.

- Uniqueness: Can the proposal be easily replicated by competitors, or does it involve proprietary technology, land rights, or specialized expertise that justify direct negotiation? Lack of uniqueness typically triggers competitive tender.

- Deliverability: Can the proponent demonstrate technical, financial, and organizational capacity to deliver? Agencies review track record, balance sheet strength, key personnel, and project execution plans.

Process Flowchart:

[Idea Submission] → [Screening (30-60 days)] → [Initial Proposal (3-6 months)]

↓ ↓ ↓

Reject Reject if no fit [Detailed Proposal (6-12 months)]

↓

[Decision: Exclusive or Competitive?]

↓

[Negotiation or RFP] → [Contract Award]

Funding Models and Risk

Availability Payments vs User-Pays

Availability payments: Government pays the private partner regular service fees (monthly or annually) based on performance standards facility availability, service quality, and output metrics. Revenue risk stays with the government; the private partner’s income is stable but tied to performance. Common for social infrastructure (hospitals, schools) and availability-based transport (shadow tolls).

User-pays: The private partner collects revenue directly from users (tolls, fares, user charges) and bears demand risk. This model suits projects with clear user benefits and willingness to pay, such as toll roads, parking facilities, and airports. Risk is higher but so is upside potential.

Hybrid models combine both: government guarantees minimum revenue, users pay above that threshold, or government tops up if demand falls short.

Risk Allocation and Affordability

Effective Market-led proposals (MLPs) allocate risk to the party best able to manage it. Construction risk (cost overruns, delays) typically goes to the private partner; demand risk may be shared or retained by the government depending on the project. Policy and regulatory risks (change of law, planning approvals) often stay with the government.

Affordability: Agencies must confirm that payment obligations fit within fiscal constraints over the contract term (often 25–30 years). Detailed financial modeling, sensitivity testing, and independent review ensure the project doesn’t compromise future budgets.

How to Prepare and Submit

Proposal Template

A complete Market-led proposals (MLPs) submission typically includes:

- Executive summary: Project overview, public benefits, investment, timeline

- Strategic fit: Alignment with agency plans, policy priorities, community needs

- Technical solution: Design, specifications, delivery methodology, innovation

- Demand and market analysis: User forecasts, revenue assumptions, sensitivity tests

- Financial model: Capital costs, operating costs, funding sources, return expectations

- Legal and commercial structure: SPV, contracts, risk matrix, governance

- Deliverability evidence: Proponent experience, key team, balance sheet, references

- Stakeholder and approvals plan: Community consultation, environmental, planning

- Public interest case: Economic, social, environmental benefits; value for money

Submission Checklist

Before submitting, verify:

- Concept aligns with agency strategic priorities and policy objectives

- Proposal demonstrates genuine uniqueness or innovation not easily replicated

- Financial model is robust, transparent, and includes independent validation

- All required approvals and consents are identified with realistic timelines

- Conflicts of interest, probity concerns, and confidentiality boundaries are disclosed

- Submission format and content meet agency guidelines (page limits, electronic format)

- Key personnel CVs, corporate structure, and financial capacity documents are included

Timeline and Bid Costs

Timeline: From concept submission to contract award, expect 18–36 months. Screening takes 1–2 months; initial and detailed proposal phases each run 6–12 months; negotiation can add another 6 months.

Bid costs: Preparing a competitive Market-led proposals (MLPs) typically costs $500,000–$3 million, depending on project complexity, due diligence depth, and advisor fees (legal, financial, technical). Proponents should budget for staged investment and assess opportunity cost if the proposal is rejected or moves to open tender.

IP, Confidentiality, Probity and Conflicts

Intellectual property: Most frameworks allow proponents to mark sections confidential, but agencies may use non-confidential elements for benchmarking. Register IP beforehand and limit disclosure of genuine trade secrets.

Confidentiality: Agencies protect commercial-in-confidence material but must comply with freedom of information laws. Expect public disclosure of contract terms, pricing, and performance standards once agreements are signed.

Probity: Agencies maintain strict separation between assessment teams and industry to avoid perception of bias. Proponents must avoid ex parte lobbying, conflicts of interest, and improper influence.

Conflicts: Declare any relationships with agency officials, advisory firms, or competing proponents. Hidden conflicts can disqualify proposals and damage reputation.

Policies by Country (US, UK, AUS, CAN, DE)

United States: Unsolicited Proposals (State Examples)

The US has no federal Market-led proposals (MLPs) framework, but many states accept unsolicited proposals for public-private partnerships (P3s), particularly for transportation infrastructure. Policies vary by state:

- Virginia: Virginia’s Public-Private Transportation Act allows unsolicited proposals with a 120-day exclusivity window if the proposal is deemed unique. The Virginia Department of Transportation (VDOT) requires detailed financial, technical, and public interest submissions.

- Colorado: Colorado’s High-Performance Transportation Enterprise accepts unsolicited proposals for toll and managed lane projects. Proposals undergo value-for-money and public benefit analysis before proceeding.

- Texas: Texas allows unsolicited proposals for transportation projects through the Texas Department of Transportation. The agency may negotiate exclusively or issue a competitive RFP based on uniqueness assessment.

PEOPEL ALSO READ : High Tech Procurement Strategy: Complete Guide for 2024

Federal guidance: The Federal Highway Administration (FHWA) provides resources on P3 procurement, including unsolicited proposal best practices, but does not mandate federal-level MLP procedures.

Key requirement: Most states require demonstration of unique value, public interest, and financial feasibility. Competitive bidding remains the default unless uniqueness is clearly established.

UK: Rail Market-Led Proposals Guidance (Note on Current Status)

The UK Department for Transport (DfT) published Rail Market-Led Proposals Guidance to encourage private investment in rail infrastructure. The framework allowed train operators and third parties to propose new stations, line extensions, and service improvements outside the regular franchising process.

Current status: Following rail sector reforms and changes in franchise policy, the Market-led proposals (MLPs) process has been largely superseded by direct contracting and integrated planning within Great British Railways. The guidance remains a useful reference but is not actively used for new proposals.

Other sectors: While rail Market-led proposals (MLPs) are dormant, the UK continues to use competitive dialogue and innovation partnerships under public procurement rules for other infrastructure and digital services.

Australia: QLD and VIC Market-led proposals (MLPs) Frameworks

Australia’s states lead globally in structured MLP frameworks:

Queensland: Queensland Treasury’s Market-Led Proposals Guidelines set out a four-stage process registration, concept assessment, detailed proposal, and contract award. Projects must demonstrate unique public value and pass rigorous value-for-money testing. Recent Market-led proposals (MLPs) include Cross River Rail station developments and renewable energy facilities.

Victoria: Victoria’s Department of Treasury and Finance operates a similar framework, requiring alignment with Infrastructure Victoria’s 30-year strategy and Cabinet approval for major projects. Victoria emphasizes probity, transparency, and competition where practical. Examples include toll road expansions and digital health infrastructure.

New South Wales: NSW also maintains an Unsolicited Proposals Guide with similar stage-gate processes and public interest tests.

Common features: All Australian frameworks prioritize transparency, independent probity advice, and competition unless uniqueness is compelling.

Canada: Infrastructure Ontario Unsolicited Proposals

Infrastructure Ontario (IO) accepts unsolicited proposals for infrastructure projects that deliver public value and align with provincial priorities. IO’s framework includes:

- Preliminary screening: Quick assessment against strategic fit, innovation, and feasibility

- Detailed assessment: Business case review, value-for-money analysis, stakeholder consultation

- Procurement decision: Exclusive negotiation or competitive RFP based on uniqueness

Examples: IO has assessed unsolicited proposals for energy projects, transit facilities, and social housing. The framework is cautious; most proposals either fail screening or proceed to competitive tender to ensure best value.

Germany/EU: Innovation Partnerships and Procurement Rules

Germany and the EU do not have standalone MLP frameworks but allow unsolicited innovation through competitive procurement mechanisms:

Innovation partnerships: Under the EU Public Procurement Directive (2014/24/EU), contracting authorities can establish innovation partnerships to develop and procure innovative products or services. This involves competitive selection of partners, joint R&D, and potential contract award without further tender.

Competitive dialogue: For complex projects, authorities use competitive dialogue to refine solutions with shortlisted bidders before final contract award.

Limits: EU rules prioritize competition and transparency. Exclusive direct negotiation is only permitted in narrow circumstances (e.g., technical monopoly, urgency). True unsolicited proposals without competition are rare and legally risky.

Practical approach: German authorities may engage informally with industry through market consultations but must follow competitive procedures for contract award.

Country Policy Matrix:

| Country | Framework Name | Exclusivity Possible? | Key Features | Current Status |

| US (state-level) | Unsolicited Proposals (varies) | Yes, if unique | 120-day windows; state-specific rules | Active (VA, CO, TX) |

| UK | Rail Market-Led Proposals | Was possible | DfT rail guidance | Dormant (superseded) |

| Australia | MLP Guidelines (QLD/VIC/NSW) | Yes, if unique | Four-stage; strict probity | Active, global leader |

| Canada | IO Unsolicited Proposals | Rare, mostly RFP | Screening; value-for-money focus | Active, cautious |

| Germany/EU | Innovation Partnerships | Limited | Competitive; R&D focus | Active, not true MLP |

Pros and Cons

| Pros | Cons |

| Lets government tap private ideas early | Risk of perceived lack of competition |

| Can speed up delivery for priority projects | Complex probity and transparency needs |

| May unlock private funding and innovation | Higher bid costs for proponents |

| Tailored risk allocation | May still move to open tender |

| Can fill gaps not in public pipeline | Not available or limited in some places |

FAQs (People Also Ask)

What is a market-led proposal?

A market-led proposal is a private company’s idea for a public infrastructure or service project submitted outside regular government tenders. The government screens it for public value, uniqueness, and affordability before deciding whether to proceed with exclusive negotiations or competitive bidding.

How is a market-led proposal different from an unsolicited proposal?

The terms are often used interchangeably. Market-led proposals typically emphasize stricter public interest and value-for-money tests, while unsolicited proposals (common in US states) may focus more on innovation and private funding. Both allow private proponents to initiate projects outside standard procurement.

What are the typical stages of an MLP?

Most frameworks involve four stages: (1) idea screening, (2) initial proposal and assessment, (3) detailed proposal and due diligence, (4) negotiation or decision to tender. Each stage includes evaluation criteria and decision gates.

Who can submit a market-led proposal?

Private companies, consortia, developers, infrastructure funds, and public-private partnerships can submit MLPs. Eligibility requirements vary by jurisdiction but typically require demonstrated technical, financial, and organizational capacity.

What criteria do governments use to assess Market-led proposals (MLPs)?

Governments evaluate value for money, public interest, uniqueness, and deliverability. Projects must offer better outcomes than public delivery or standard procurement, align with strategic priorities, demonstrate innovation or proprietary elements, and show credible execution plans.

Do MLPs always lead to exclusive negotiations?

No. Many Market-led proposals (MLPs) proceed to competitive tender, especially if the idea can be replicated by other bidders. Exclusivity is granted only when the proposal has genuine uniqueness, proprietary technology, specialized land rights, or capabilities competitors cannot match.

What documents do I need in an Market-led proposals (MLPs) submission?

Core documents include an executive summary, strategic fit statement, technical design, demand and financial model, legal structure, deliverability evidence, approvals plan, and public interest case. Specific requirements vary by agency guidelines.

How long does anMarket-led proposals (MLPs) assessment take? From concept submission to contract award, expect 18–36 months. Screening takes 1–2 months; initial and detailed assessments each run 6–12 months; negotiation or tendering adds another 6 months.

How are confidentiality and IP handled?

Proponents can mark sections commercial-in-confidence, but agencies may use non-confidential elements for benchmarking. Freedom of information laws require disclosure of final contract terms, pricing, and performance standards. Register IP beforehand and limit disclosure of genuine trade secrets.

What funding models work best for Market-led proposals (MLPs)?

Availability payment models (government pays for performance) suit social infrastructure with stable demand. User-pays models (tolls, fares) work for projects with clear revenue potential. Hybrid models blend both, sharing demand risk between public and private partners.

Which US states accept unsolicited proposals?

Virginia, Colorado, Texas, Florida, and several other states have active unsolicited proposal policies for transportation P3s. Check state Department of Transportation websites for current guidelines, eligibility, and submission requirements.

PEOPLE ALSO READ : What Is a Technology Control Plan (TCP)?

Are MLPs allowed in the UK, Australia, Canada, and Germany?

Australia (Queensland, Victoria, NSW) leads with active, comprehensive Market-led proposals (MLPs) frameworks. Canada (Infrastructure Ontario) accepts unsolicited proposals but most proceed to competitive tender. The UK’s rail MLP guidance is dormant following sector reforms. Germany/EU use innovation partnerships and competitive dialogue, not true Market-led proposals (MLPs).

Glossary

Availability payment: Government pays private partner regular fees based on facility availability and service performance, not usage or demand.

Due diligence: Rigorous verification of proposal assumptions, financial models, technical feasibility, and legal structure before contract award.

Probity: Ethical conduct, transparency, and fairness in procurement to avoid conflicts of interest, favoritism, or corruption.

Public interest: Benefits to the community economic growth, social outcomes, environmental improvement that justify public investment or support.

Risk allocation: Assignment of project risks (construction, demand, regulatory) to the party best able to manage each risk.

Uniqueness: Proposal features (proprietary technology, land rights, specialized expertise) that cannot be easily replicated by competitors.

User-pays: Private partner collects revenue directly from users (tolls, fares) and bears demand risk.

Value for money: The project delivers outcomes more cost-effectively than public delivery or alternative procurement, considering whole-of-life costs, risk, and quality.

READ MORE : Super Converters